Individual Investors Are In Trouble

Everyone wants to be great at investing. Very few are.

For every Warren Buffet and Charlie Munger there is, well, the rest of us. Successful investors start with faith in the future, then add patience, and discipline. Successful portfolios start with asset allocation, add diversification, and stay on track with rebalancing. Successful investors ignore the news cycle and have safeguards in place for managing emotions.

Individual investors routinely ignore this advice. This harsh reality is made clear by DALBAR, the financial research firm who publishes an annual study of investor performance and behavior. Here are the most recent results.

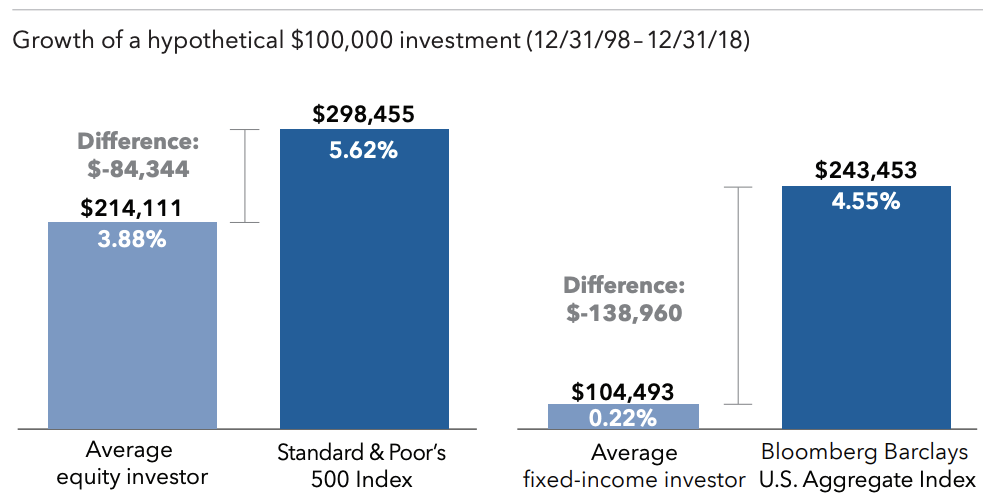

The study shows that the S&P 500 earned 5.62% over the 20 years ending December 2018. However, individual mutual fund investors only earned 3.88%. Individual investors did 1.74% worse than their investments.

That doesn’t sound too bad until you add it up. $100,000 invested in the S&P500 in 1998 and earning 5.62% per year gives you $298,455. The average individual mutual fund investor also started with $100,000 earned 3.88% and ended up with $214,111. That is a disappointing $84,344 difference. Bond investors did even worse.Individual investors have a problem. So, why are the DALBAR numbers are so bad?

We Have Met The Enemy

The problem is that we are Humans. We make decisions every day assisted by, some would say driven by, emotions. It is just who we are. Unfortunately, emotional decision making works against us when investing. Emotion driven investment decisions rarely produce successful outcomes.

What is an emotion driven investment decision? It is a decision that is some combination of doing the wrong thing, at the wrong time, for the wrong reason. Here are some of the bigger emotional hurdles we face as investors and what to do about them.

Performance Chasing

Investors who look at last year’s results and invest the “best” performing funds are highly likely to lose money over the long term. Investing by looking in the “rear-view mirror” is not a successful strategy. All they are doing is looking at a list of mutual funds in their 401k plan and choosing the one or few that are performing the best and putting their money there.

Given the cyclical nature of investing, it should be obvious why this does not work. Next year’s high performers and almost always different from last year’s. So, let’s set this idea aside right here and now.

Casino Investing

Many people think they can make money by winning the lottery. If it was easy, then everyone would be a millionaire. Playing the lottery is a tax on people who are bad at math. It is appealing that a little money can turn into a lot of money. Yes, someone wins but the odds are highly stacked against you.

Another aspect of the casino mentality is based on the thrill or “having fun” with their investments. Investing is not entertainment. It is based on having faith in the future, patience, and discipline. Those principles produce many good outcomes, but fun is not one of them.

News-based Influence

Jason Zweig, the author of the Wall St. Journal column “The Intelligent Investor,” was among the first to highlight the innovative research of cognitive psychologist Paul Andreassen. In the late 1980s Andreassen conducted a number of experiments which showed, “paying close attention to financial news can lead investors to trade too much and to earn lower returns than those who tune out the news.” I not only agree that this is not only a real problem, but it is getting worse.

To further quote Zweig, “Financial journalism is in the change business: focusing on whatever has just changed and focusing most intently on whatever has just changed the most and the fastest. If you are an investor, change is likely to matter very little: Your results should come not from anticipating changes in the financial markets, but from avoiding changes in your own plan.”

To put it succinctly, don’t go Mad Money with your future.

Fear and Greed Investing

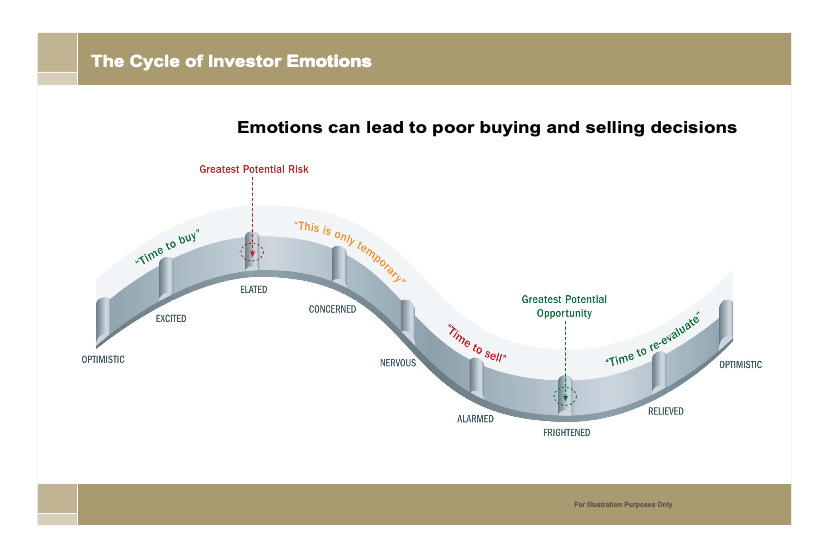

This is a tough one. The best time to invest is when things look the worst. The worst time to invest is when things look great. Just take a look at “The Cycle of Investor Emotions.”

Does this feel familiar? This is what causes humans to buy at the top and sell at the bottom. Succumbing to fear and greed is one of the biggest reasons for poor individual investor outcomes. How were you feeling at the end of February 2009? It looked and felt like the end of the financial world as we knew it, right? And yet it was the beginning of one of the most spectacular market expansions in our lifetime.

So, What Should I Do?

It should be clear that individual humans are, on average, not good at investing. This is compounded by the low odds of randomly picking successful stocks. Here are some ways to do better.

- Invest with indexes – Instead of trying to predict the future, acting on impulse, betting your savings on tips and hunches, or being swayed by the media you rely on academic research. Academia has been the source of most of the significant advances in Finance. The index fund is one such advance.An index fund is designed to mimic the performance of a commercial measure of the markets. An S&P 500 fund holds all the stocks that comprise that index. Your experience will mirror the index less the cost of administering the fund.

- Work with a real financial advisor – Working alongside an evidence-based wealth manager is one of the easiest ways of improving your investment experience. Not only does this remove the emotional aspect of investing, working with a professional advisor will result in the creation and maintenance of an investment portfolio that is perfectly aligned with your values, passions, and purpose.Having a trusted advisor to talk to when times are tough or exuberant is an excellent way to stay focused and on track. According to Vanguard (and as quoted in Tony Robbins 2017 best seller “Unshakeable”) a professional, fiduciary advisor can add significant value, as much as an additional 3%, to your efforts even after paying their fee.